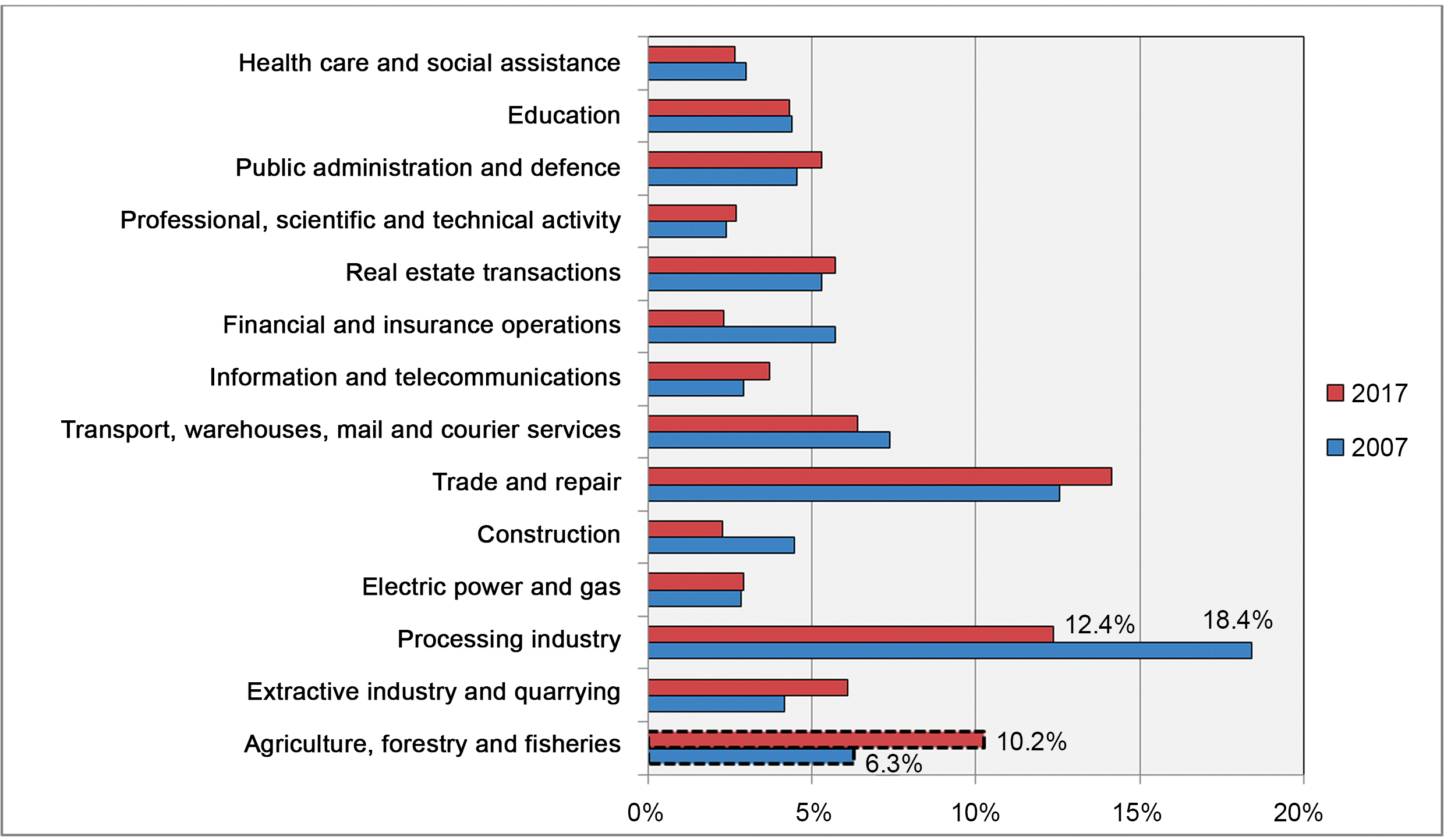

Since the beginning of Ukraine’s independence, agriculture has been seen as the new backbone of the country’s economy. The fertility of ‘chernozem’ was supposed to provide the Ukrainian market with food products and, furthermore, accumulate resources for the development of other sectors of the economy. Indeed, the industry is steadily heading towards first place in the economy. The share of agriculture, forestry and fishing in the gross domestic product has increased by 1.6 times compared to 2007 and now amounts to 10.2%[1]. The processing industry, on the other hand, which by definition deals with the processing of raw materials into final products, is experiencing a reduction.

Figure 1. Contribution to GDP by sector of Ukraine’s economy in 2007 (bottom) and 2017 (top).

Source: compiled by the author based on the data of the State Statistics Service of Ukraine[2].

In this article, we will look at the consequences of the economy being raw material oriented, and the place of agriculture in such processes. The article will show what sectors of the economy contribute to the state budget, and how unambiguous is the role of international creditors in Ukraine’s tax policy. The main schemes and the scale of losses due to tax evasion in the agricultural sector will be presented.

Raw materials defining the nature of Ukraine’s economy: trends and implications

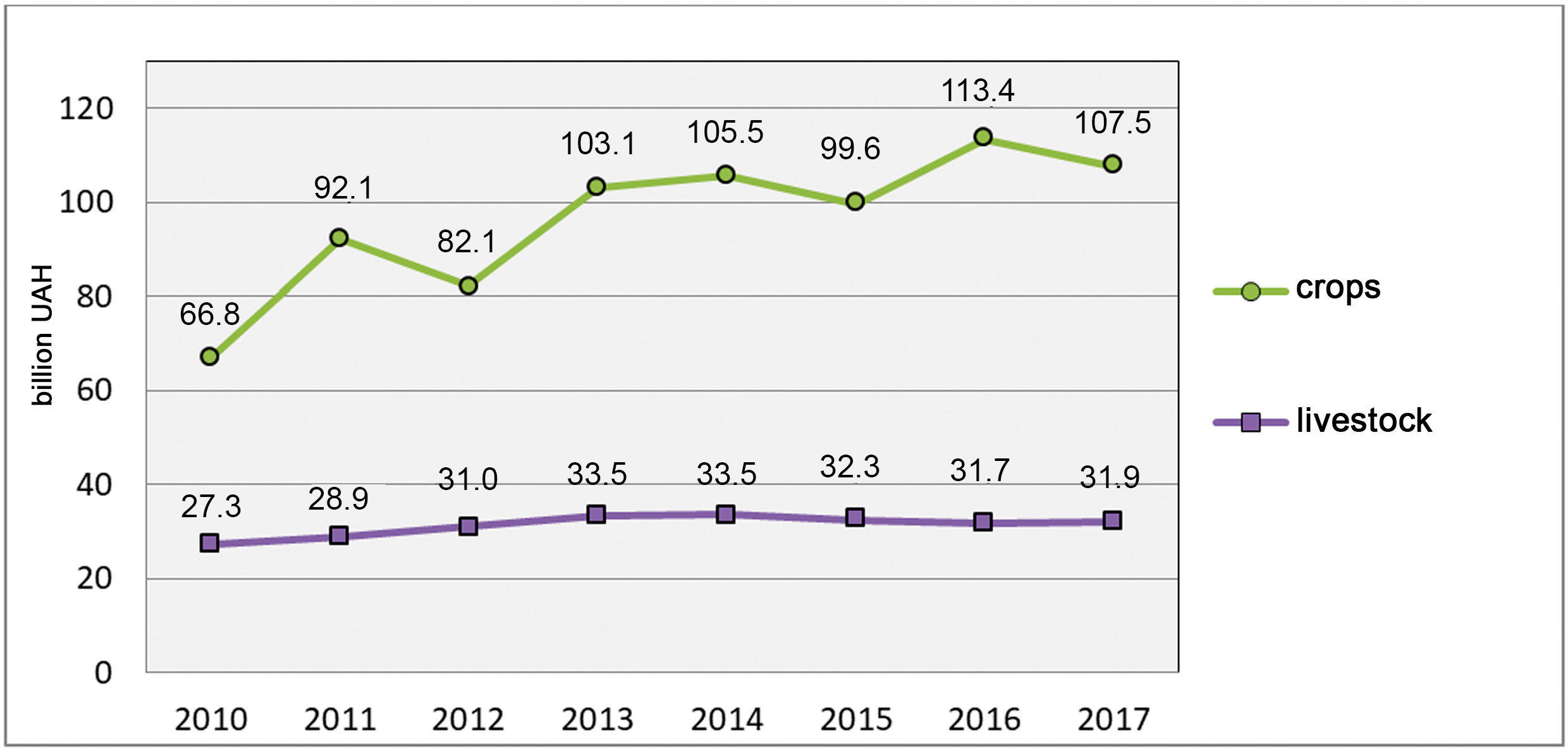

The category ‘agriculture, forestry and fisheries’ is growing thanks to agriculture, particularly crop production, which makes up the lion's share of this sector of the economy[3]. Livestock production, on the contrary, is in crisis. This is a result of fierce competition with foreign suppliers, particularly from the EU, who can offer better products for the Ukrainian market. For instance, pork imports from the European Union increased by 64% in 9 months of 2017 (Germany, Denmark and the Netherlands together supply 65% of pork from the EU).

Until recently, there were no effective programmes to support Ukrainian livestock farmers. Statistics confirm the uneven development of these two sub-sectors of agriculture.

Figure 2. Gross output of agricultural enterprises of Ukraine (at constant 2010 prices, billions of hryvnias)

Source: compiled by the author based on the data of the State Statistics Service of Ukraine.

In 7 years, crop production has increased by 1.6 times in monetary terms (considering inflation), while livestock production remains almost at the 2010 level.

Such disparities in the agricultural sector have a direct impact on the development of rural areas. The changes are even more striking if we draw a comparison with 1990. Back then, Ukraine had 7 times more cattle and 3 times more pigs than today. This reduction means that production sites were shut down. As a result, the share of workers in agricultural enterprises decreased by 5 times, and by 10 times in livestock production (Лупенко, Тулуш 2016).

A part of the working population in the villages began to work in their own, less efficient households, while the others switched to a different activity. Still, more than 2.8 million people work in the industry now, which accounts for 18% of the employed population of Ukraine. The situation is somewhat better with poultry farming, which has received considerable investments for the establishment of new production sites. However, due to the high level of automation, few jobs are created at such enterprises. Of course, the focus should not be on the jobs but on the reduction of the socially necessary time for production. But in the absence of effective professional reorientation programmes, the most ‘active’ workers are forced to seek employment overseas, and the others are condemned to poverty and unemployment.

However, even the success of crop production does not ensure the growth of money inflows to the country, which affects resources for consumer demand and the development of the economy in general. The reason lies in the raw nature of agricultural products (with low added value), the price of which is falling on world markets. As a result, Ukrainian producers cannot compensate for the negative trade balance: we import more in dollars than we export. Ukraine covers this shortfall with the funds of new external loans, spending them not on development but on stabilising the financial situation.

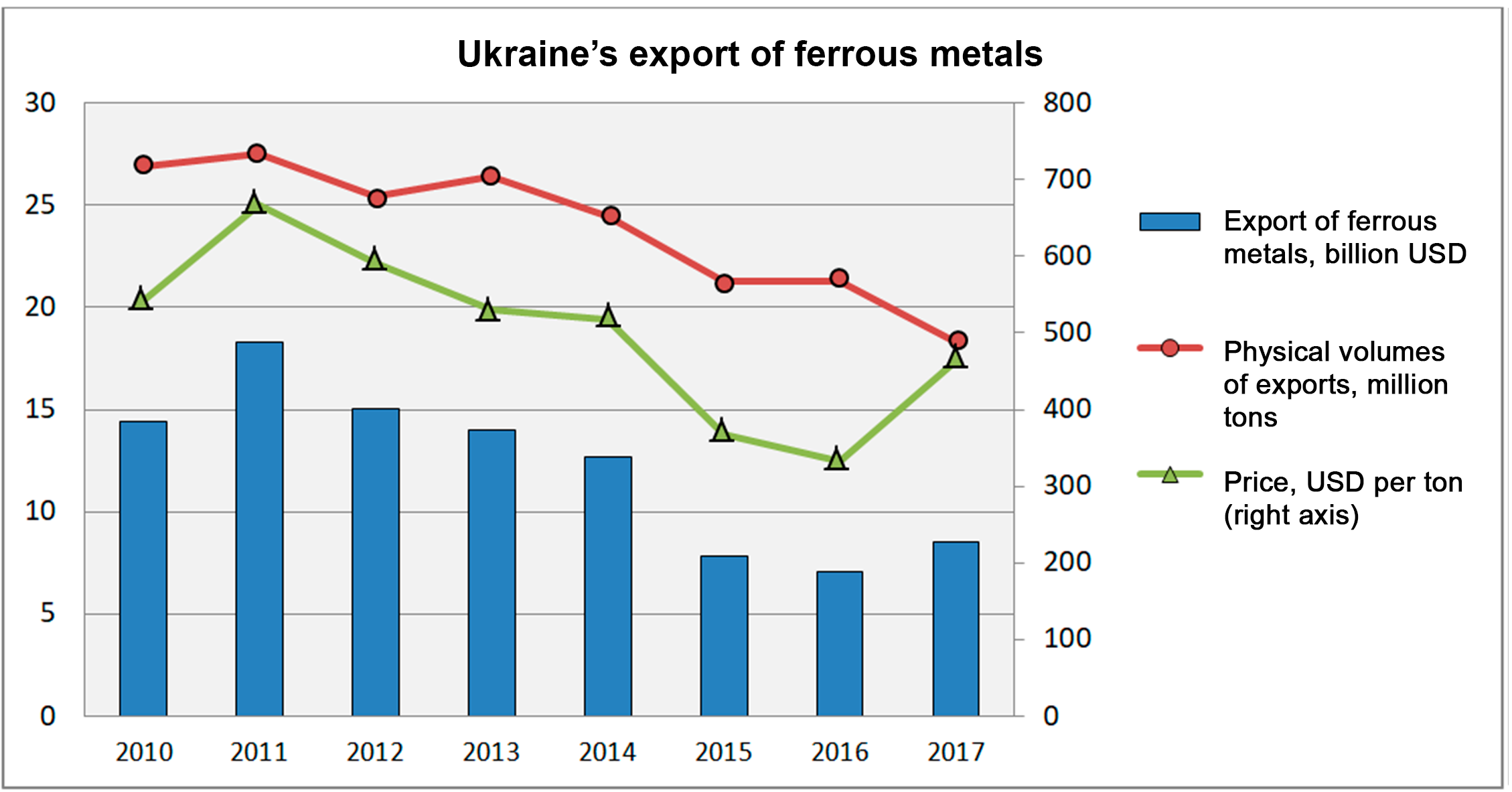

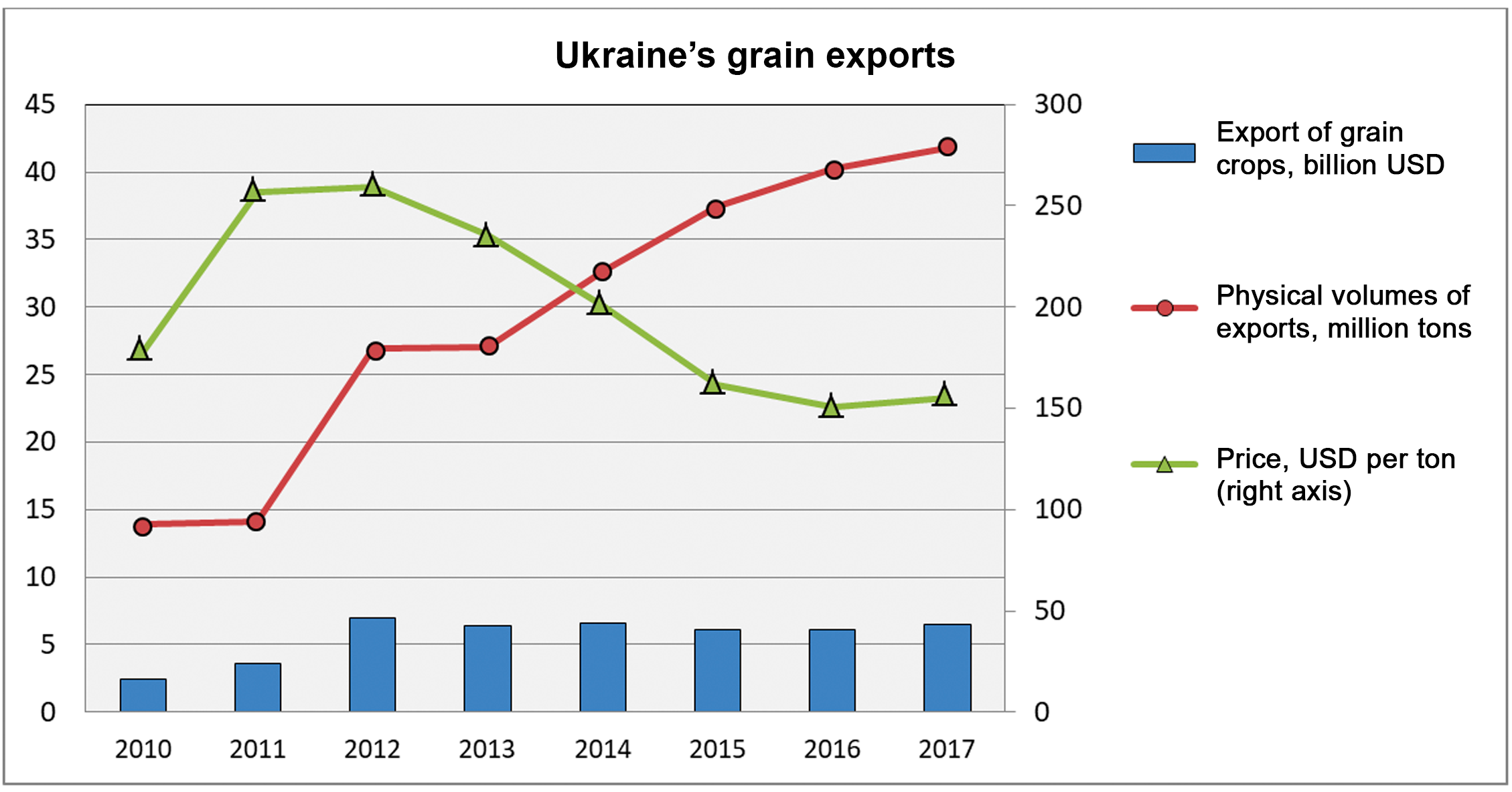

It is worth mentioning that other Ukrainian producers of raw materials and intermediate goods are also under price pressure. The metallurgical industry, which until recently accounted for the largest share of exports, has significantly reduced production volumes, especially after losing control over enterprises in the east of Ukraine. In Figures 3 and 4, we compared the foreign currency denominated income of farmers and metallurgists with price fluctuations for their products. Ferrous metals and grains were chosen for comparison as these are the most important components of Ukrainian exports (total of 40% in 2016-2017).

Figure 3. Ukraine’s export of ferrous metals in physical and monetary terms in 2010-2017.

Source: compiled by the author based on data from the National Bank of Ukraine.

Figure 4. Ukraine’s grain exports in physical and monetary terms in 2010-2017

Source: compiled by the author based on data from the National Bank of Ukraine.

Even the increase in grain exports to 42 million tons a year does not sufficiently increase the inflow of foreign currency to Ukraine. This is because the average price for such products fell almost twice — to 155 US dollars per ton. The situation was more favourable last year for the metallurgical industry. The correction of prices on the world markets after the increase in demand from China compensated for the fall in physical volumes of exports of ferrous metals. But in general, the raw material market remains poorly forecasted. Such trends indicate the falsity of the statement about the priority of the agrarian vector for Ukraine. This sector cannot ensure the sustainable development of the country.

On the other hand, having even such a ‘raw’ potential, one should understand to what extent it can be used to accumulate resources for processing raw materials within the country and even to boost other sectors of the economy and social sphere. The latter means the development of science-intensive fields and ensuring wider access of the population to social benefits.

The role of agriculture in replenishing the state budget

We have come to the issue of tax policy. Taxes ensure the redistribution of wealth through individuals’ and legal entities’ payments to budgets and trust funds. In a market economy, such redistribution performs regulatory and social functions, reducing social inequality, stimulating priority sectors of the economy or science, etc. At the same time, the level of taxation should ensure the reproduction of production cycles and leave enterprises with resources for modernisation.

Let’s have a look at the change in the tax burden in certain industries and in agriculture, the new ‘flagship of the economy.’

As a result of recent tax reforms and the reduction of pressure on businesses, taxes and fees from individuals make up an increasing share of budget revenues. In 2017, such payments amounted to 615 billion hryvnias.

The main taxes enterprises pay to the budget:

– corporate income tax (tax on the difference between income and expenses, taking into account depreciation);

– rent payments for the use of subsoil (payment for the right to extract mineral resources on the territory of Ukraine);

– value-added tax, VAT (payment of the difference between the calculated amount of VAT for the sold goods and the amount of VAT that was paid when purchasing raw materials for production);

– excise tax (tax on the consumption of highly profitable excise goods, such as alcohol, tobacco or fuel materials).

The last two taxes, VAT and excise, are paid mainly by individuals. A seller includes the taxes in the product price. The enterprise becomes an intermediary between consumers and the state budget. But since our focus is on agriculture, an export-oriented industry, we will also analyse VAT. In Ukraine, exports are generally taxed at a zero VAT rate, and the amount of net income from this tax is the largest contribution of agrarians to the Treasury. Such a zero rate aims at supporting the competitiveness of Ukrainian exports. VAT rates and benefits in agriculture have been causing fierce confrontations between Ukrainian farmers, Ukraine's external creditors and state authorities.

Below is the result of an analysis of data requests received from the State Fiscal Service for 2013-2017.

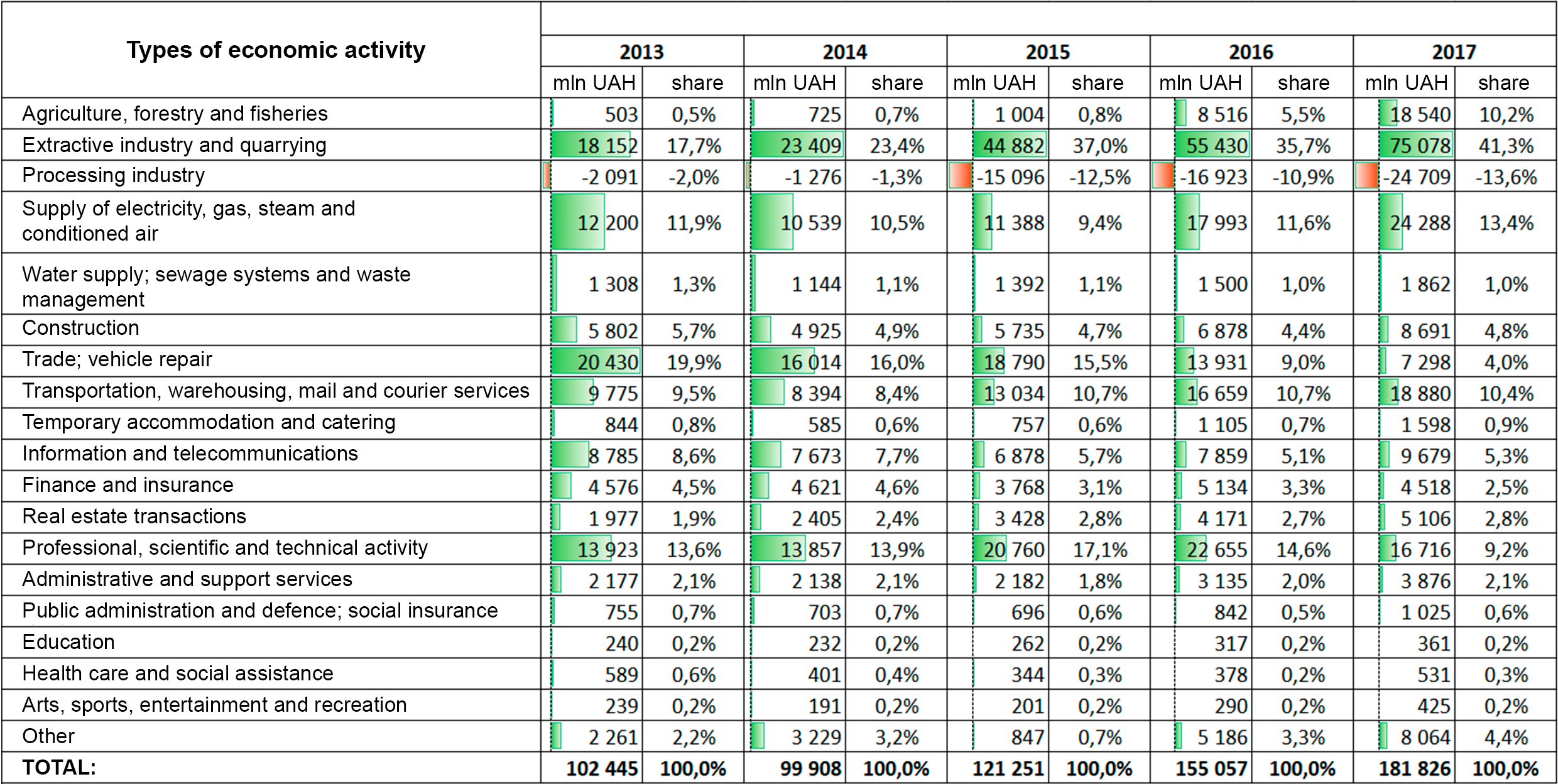

Table 1

Volumes and structure of the tax burden of types of economic activity (in actual prices)

Source: author’s calculations based on data requests from the State Fiscal Service of Ukraine.

The amount of taxes paid in the table is the sum of paid income tax, rent payments and net income from value added tax (VAT payment minus VAT refund). You can read more about the calculations in the attached appendix.

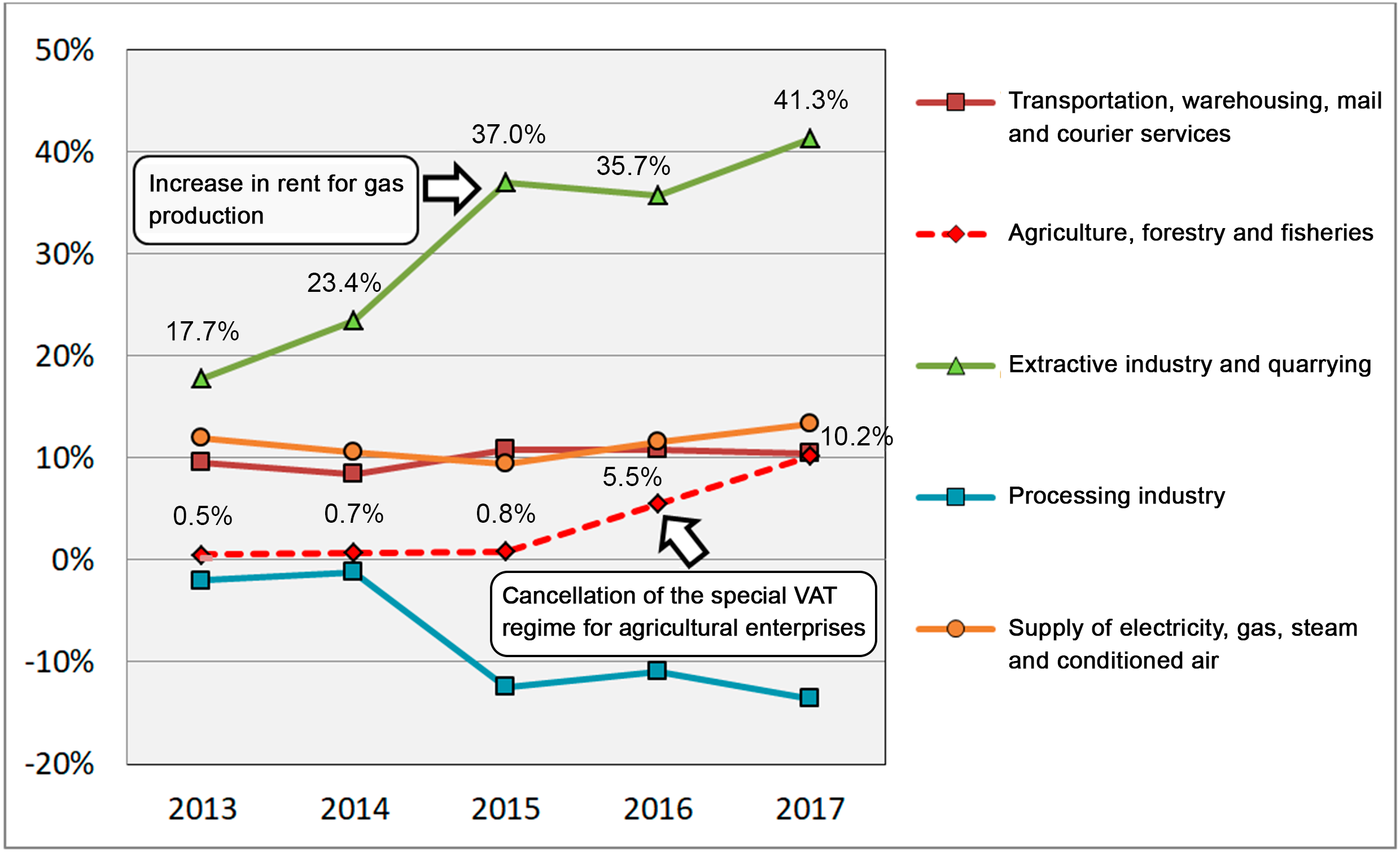

Figure 5. The share of certain sectors of Ukraine’s economy in taxes paid in 2013-2017

Source: author's calculations based on data from the State Fiscal Service of Ukraine.

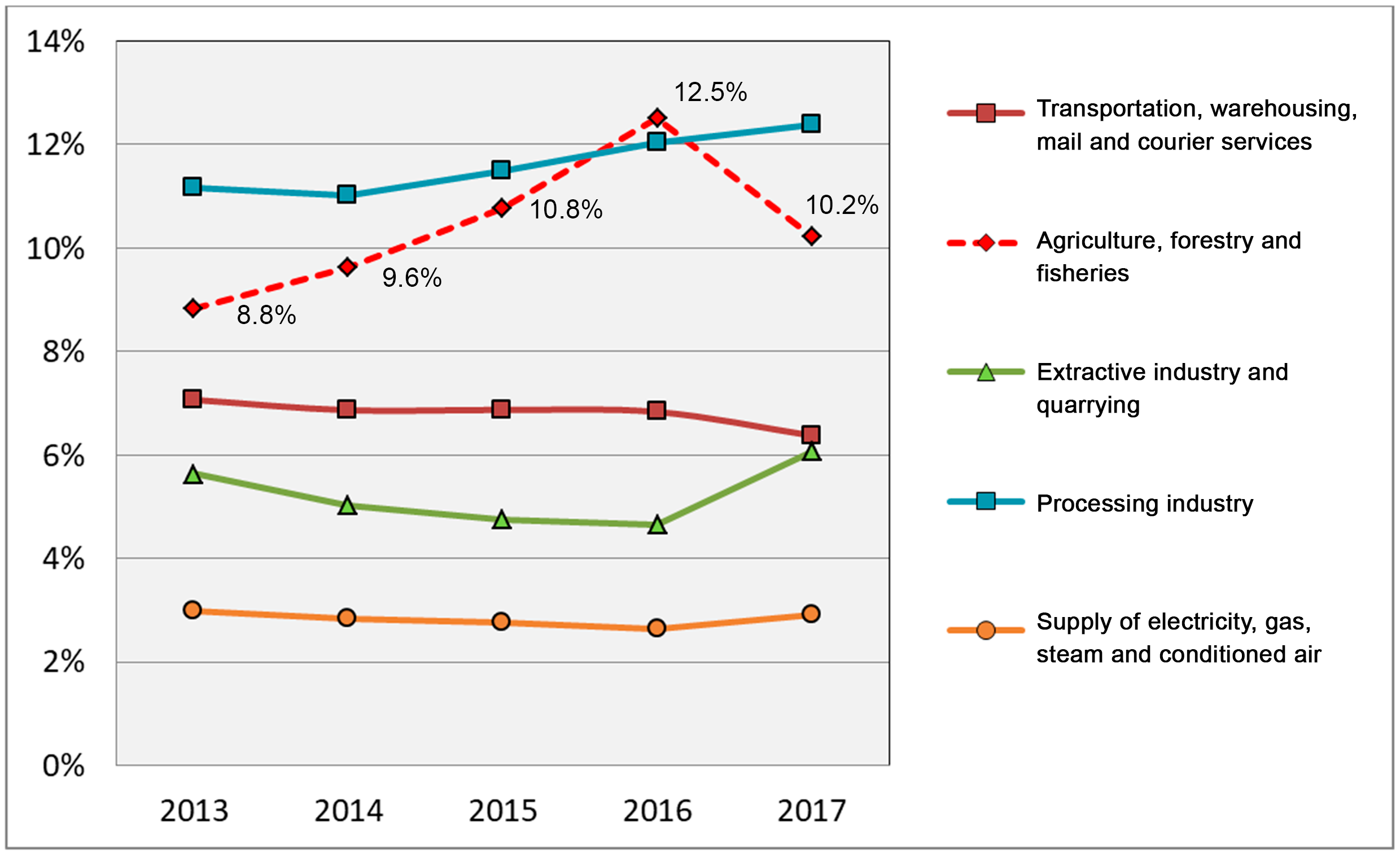

Figure 6. The share of the sectors in the gross domestic product of Ukraine in 2013-2017

Source: compiled by the author based on the data of the State Statistics Service of Ukraine.

Conclusions based on the data above

Mining enterprises pay the most taxes among legal entities. In 2017, their share grew to a record 41%, amounting to 75 billion hryvnias. This exceeds the share of the industry in the creation of the gross domestic product by almost 7 times. This growth is a result of the step-by-step increase in rent payments for gas extraction from Ukrainian subsoils, which accounts for ¾ of all rent income. In August 2014, the general rate of rent was raised to 55%; since 2015, it has been 70% of the cost of extracted gas. And contrary to the claims of private mining companies (which own about ¼ of the production), the nearly threefold increase in the tax did not lead to business closure. Gas production in Ukraine in 2017 was 20.5 billion cubic metres – just like in 2014 before the tariffs were raised. Moreover, private miners managed to increase their production to 4.5 billion cubic metres. It should be noted that the gas produced in Ukraine covers 56% of all needs, and the production of state-owned companies alone exceeds the population’s need for natural gas by 4% (as of 2017). With such production volume and an estimated cost of gas of 20-30 dollars (according to the Ministry of Finance), the population still receives gas at a high price linked to the world market prices.

In March 2018, the process of deregulation of gas production began, aimed at simplifying investments in this industry. An even more important novelty introduced this year is a preferential rate of rent payments for new gas fields — 12% and 6% for production from depths of more than 5 km. At the same time, it is forbidden to increase rent rates until 2023. In this way, a preferential regime has been established for large corporations to enter the Ukrainian market. The new policies are beneficial to foreign investors. Thus, American companies Frontera Resources, Longfellow, and SigmaBleyzer have already announced their plans to enter the Ukrainian market. The increase in energy independence due to the increase in gas production is an extremely necessary phenomenon. But under these conditions, the interests of the other spheres of society (which can be developed thanks to adequate taxation of super-profitable businesses) should not suffer.

The compensation processing industry receives from the state budget continues to surpass the taxes it pays to it. This is due to the reimbursement of VAT from the budget, which exceeds the income from the tax in recent years. Having paid UAH 25.5 billion in VAT in 2017, industry enterprises received 60.5 billion in compensation. One of the reasons for such unevenness is the 2017 introduction of a digital register of automatic VAT refunds. The tool allowed to reduce the tax refund debt by 94%, or 14.4 billion hryvnias. Interestingly enough, the VAT refund is provided to a rather narrow range of recipients. In 9 months of 2017, 52% of refunded VAT was received by 20 large enterprises. Among those were the largest agricultural enterprises of Ukraine: ‘Kernel-Trade’ (4 billion UAH), ‘Myronivsky Hliboproduct’ (1.4 billion UAH), ‘Nibulon’ (1.6 billion UAH), ‘Suntrade’ (1.8 billion UAH); and large metallurgical enterprises: ‘Azovstal’ (3.8 billion UAH), ‘ArcelorMittal Kryvyi Rih’ (3.1 billion UAH), Illich Iron & Steel Works (UAH 2.8 billion) and others (Office of Financial and Economic Analysis in the Verkhovna Rada of Ukraine 2017). If we separate the income tax, the processing industry ranks third after the extractive industry and trade and, as of 2017, pays a total of 9.8 billion hryvnias to the budget. For comparison, all agricultural enterprises paid as little as 0.6 billion in 2017.

In 2016-2017, agriculture reached the level of tax revenues, which corresponds to the share of the industry in the country’s GDP. Until 2016, agricultural enterprises (mainly crop producers) functioned under ultra-preferential conditions: they used to pay a minimum of funds to the budget due to significant tax benefits and state support. Those include a single tax for agricultural producers and a special regime for value-added tax. Agricultural producers were exempt from corporate income tax. A fixed tax rate applied to them, linked to a normative monetary valuation of the land, which had not been adequately revised for a long time. Another benefit was a special VAT regime. Agricultural enterprises did not pay VAT to the budget; instead, they accumulated the money in special accounts. The funds were then used in business activities such as the purchase of raw materials or equipment. In 2016, the benefits were reduced, and then cancelled completely in 2017.

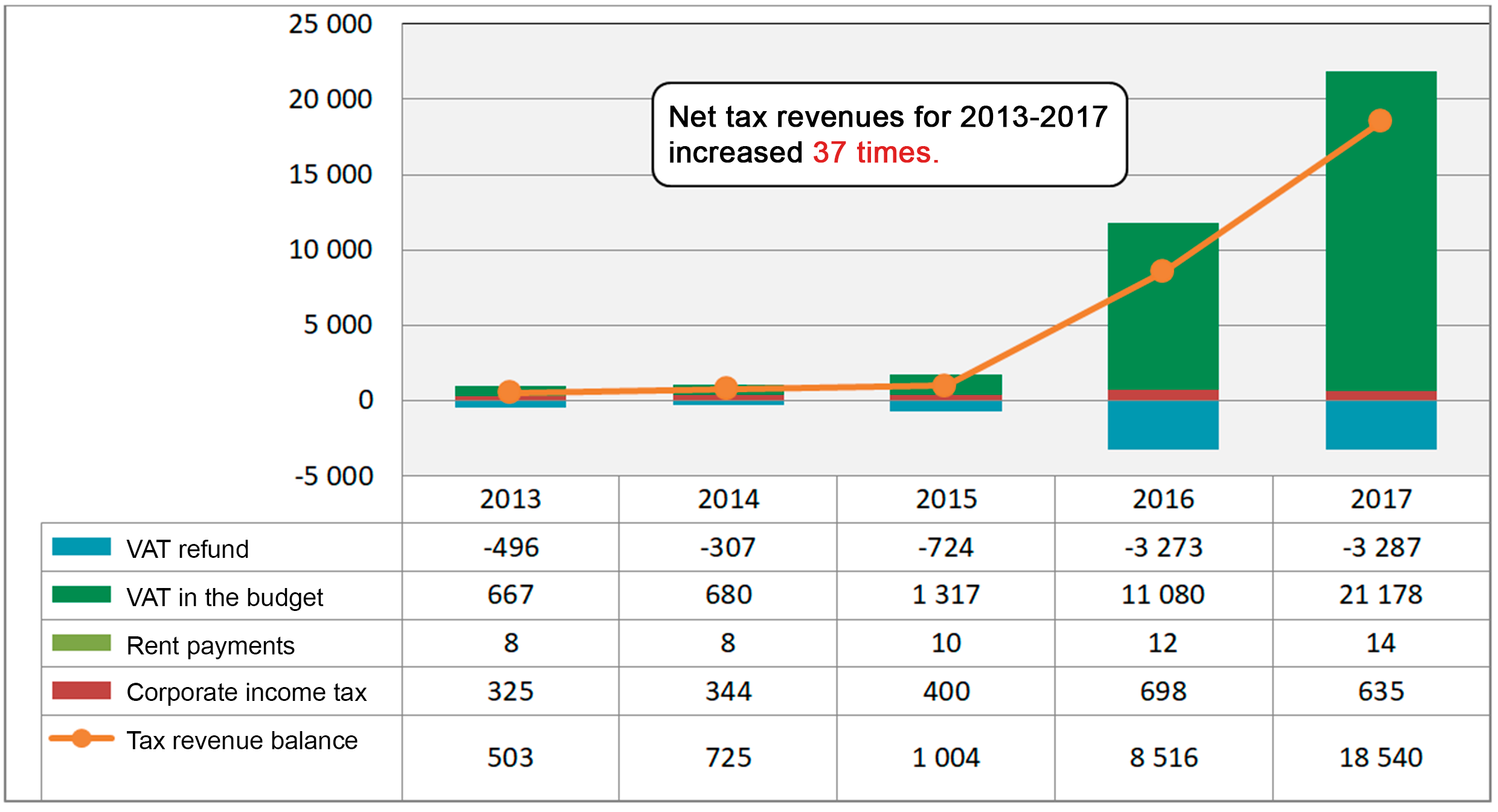

A more detailed structure of agriculture, forestry and fisheries taxes is shown in Figure 7.

Figure 7. Dynamics of taxes paid by agricultural, forestry and fishing enterprises to the Consolidated Budget of Ukraine in 2013-2017

Source: author's calculations based on data from the State Fiscal Service of Ukraine.

Thus, agricultural enterprises still pay a rather low corporate income tax. The enterprises artificially understate the amount of taxable income — and increase expenses. It is much easier for Ukrainian tax officials to ensure the collection of value-added tax. Since 2015, the balance of VAT payments has significantly increased. As of 2017, enterprises in the industry transfer almost 18 billion hryvnias to the budget. As a result, the balance of tax revenues increased 37 times over the past 4 years.

The agrarian lobby tried to stop the process of cutting tax benefits, warning about the scale of the ‘noose’ being tightened around the country’s agriculture. As ‘tightening the belt’ for agrarians was one of the main requirements of the International Monetary Fund[4], the VAT tax benefit was eventually cancelled (see pp. 13-14 of the Memorandum on Economic and Financial Policy with the International Monetary Fund). After all, no tragedy happened — export volumes of certain types of agricultural products continue to grow. Even the official figure for the profitability of grain production remains at the level of 38-40%.

Tougher measures against exporters are planned for 2018. The changes should affect the export of technical crops, such as sunflower, rapeseed and soybean. Starting September 2018, the zero rate of VAT on the export of these products will be abolished. This means that the exporters will have to pay an additional 20% of the value of foreign contracts, as when trading on the Ukrainian market. A reaction to these changes was a wave of indignation and even decisive actions such as the closure of highways in the regions. Representatives of producers and exporters claim that the new amendments to the tax rules are being lobbied by large processing enterprises and will lead to a drop in direct producers’ purchase prices. The accusations are not devoid of logic. But under favourable conditions, such protectionist measures can boost the processing of raw materials in the country. This applies primarily to rapeseed and soybeans; 98% of sunflower is processed domestically anyway. As a result of successful stimulus measures in previous years, ready-made products are being exported, including sunflower oil, which accounts for more than 50% of world exports of this product. The share of soybean and rapeseed processing is even lower — 20-25% and 10%, respectively. The rest is supplied mainly to the EU for biofuel production. But thoughtless drastic changes in the taxation of the export of these crops can really provoke the growth of a shadow market in which producers will not pay any taxes.

Subsidies instead of special regime

The abolition of the special VAT regime for agricultural producers, which the IMF insisted on, was partially offset by a direct subsidy that the government introduced instead. The subsidy is a return of funds by producers in the amount proportional to the VAT paid by them. This is basically the same special regime but with one important difference: the amount of the subsidy is limited, therefore, not every producer will receive it. In 2017, such subsidies were provided in the amount of 4.1 billion hryvnias (according to the State Treasury), which is significantly less than the amounts that remained for farmers during the period of the special VAT regime.

The amount of subsidies and the unevenness of their distribution have already become the subject of numerous scandals. In 2017, about half of the total subsidy (2 billion hryvnias) was received by the enterprises of the Myronivskyi Hliboproduct group belonging to the oligarch Yuriy Kosyuk (OFEA 2017). Indeed, large businesses pay the most VAT and, therefore, can claim the most refunds. But this contradicts the government’s rhetoric of supporting small and midsize businesses and stimulating competition in the market.

In 2018, the agricultural subsidy is expected to increase to 6.3 billion hryvnias. Of them, 4 billion are going to be allocated to support livestock production, which does not have such a quick payback as grain production and is not that attractive to private investors. There are interesting types of subsidy, such as partial compensation for the cost of livestock buildings, the purchase of Ukrainian-made agricultural machinery, or targeted support for farms. However, if large-scale structural change is to be implemented, the scope of such support should be significantly greater than the 1% of the GDP allocated to the agricultural sector.

It should be noted that small producers are generally deprived of access to VAT refund subsidies as they are not registered as payers of this tax.

Ways of tax evasion in agriculture

In addition to the analysis of the official taxation, we will also look into the illegal methods to minimise tax payments.

1) Offshoring.

One of the main ways to minimise tax payments is to understate the export price by selling products through offshore intermediaries. This way, the majority of Ukrainian grain is supplied to world markets. Of course, the product is not sent to the Virgin Islands or Switzerland – all the arrangements are made on paper. Part of the income is hidden from taxation, and the profit is left on the account of an offshore company. Another research we have conducted deals with this issue. It analyses capital withdrawal schemes in the agricultural sector and estimates the amount of budget losses. In 6 years, the state loses about 1.2 billion US dollars only on the export of corn.

2) Using a special tax regime.

Even after understating their revenues via offshore schemes, businesses still often receive profits that they do not wish to tax. A special tax regime comes in handy.

Under this regime, the agricultural producer pays a fixed amount, which is tied to the normative assessment of the land they cultivate. Such payers are exempt from corporate income tax, land tax, and water charges. The status of such a payer can be obtained if agricultural products account for at least 75% of the enterprise’s turnover. The rate of this tax has been significantly revised in recent years (2015-2017). For arable land and pastures, it doubled, increasing from 0.5% to 1% of the normative land assessment. According to data received from the Federal Tax Service, the amount of this tax increased to UAH 4.97 billion in 2017. But even such amounts are much smaller compared to the taxes paid, for instance, by the processing industry (9.8 billion in 2017).

The special regime can be illegally used according to the following scheme. Exporters do not have the status of agricultural producers and, thereby, must pay taxes on their profits. When receiving a profit in the reporting period, they increase their expenses (and reduce their profit) using fictitious purchases from agricultural producers they are affiliated with. This way, it is easiest to provide ‘services’ that are difficult to calculate and verify. If an agricultural producer has a large turnover of products, they are able to provide such services within the 25% of non-agricultural activity they are allowed to have. In other cases, companies ‘purchase’ products they grow themselves. Its origin can be hidden by reducing the reported yield.

3) Shadow market of crops.

Some of the grain traders (that is, every third company, according to tax officials) trade grain bought on the black market, which is estimated at 40% of the total agricultural turnover. For a small farmer, who often works semi-officially, it is easier to receive payments for goods in cash. As a result, an illegal tax credit is formed: the state has to return the value-added tax to the trader, compensating for the VAT included in the price of products of fictitious VAT payers. In reality, the trader bought it for a minimum price and did not pay VA, passing the funds through such a conversion centre for a small commission. The scale of such schemes is enormous. In 2015, the Tax Office estimated the amount of losses to the budget at 2.8 billion hryvnias. In 2016, the Fiscal Service prevented the illegal reimbursement of VAT to fictitious agricultural producers in the amount of 300 million hryvnias. As you can see, the number of registered violations and their exposure differ significantly.

4) Shadow cultivation of agricultural land.

There are 42.7 million hectares of agricultural land in Ukraine, 25% of which are state-owned. In Ukrainian realities, this becomes a temptation governmental officials can hardly resist. State-owned agricultural land is often used illegally, for instance, being transferred to private companies. Of course, official reports do not reflect the harvest from such lands. So what can be done to it? For further sale, the harvests must be registered. In this case, an owner can overstate the yield on their legally owned land. This way, a producer avoids the land tax, and an official receives a bribe for transferring the land (while the national agricultural statistics get distorted).

There have been numerous accounts of such practices in the country. The National Anti-Corruption Bureau of Ukraine (NABU) deals with the issue. The bureau is investigating illegal schemes involving 8,000 hectares of state-owned agricultural land. The estimated amount of losses from the corruption schemes in agriculture exposed by NABU detectives exceeds 2 billion hryvnias. A vivid example is the practice of transferring land for private use from the fund of academic institutions, particularly the National Academy of Agrarian Sciences. The land meant to be used by scientists is given to businesses. Thus, a member of parliament was involved in the illegal lease of 1.6 thousand hectares in Khmelnytskyi Oblast. Another questionable actor is an enterprise ‘State Food Grain Corporation,’ whose management was exposed in a case of fictitious trade and theft of money in particularly large amounts.

Conclusions

The development of the Ukrainian economy takes place according to the scenario of reducing high-tech production and focusing on the production of raw materials that are processed overseas. In agriculture, crop production is rapidly developing as it attracts investors with its quick payback. High profitability is achieved thanks to cheap labour, favourable natural conditions, sufficiently developed transport infrastructure and, until recently, state support mechanisms. The increase in the export of agricultural products does not ensure a corresponding increase in foreign currency income to the country. As with the metallurgical industry, this is caused by the raw nature of the products (low value added) and fluctuations in the prices of such goods on world markets.

The destruction of livestock production, on the other hand, leads to the rapid degradation of rural areas due to the closure of numerous enterprises and the migration of the labour force overseas. The state subsidies for the development of livestock production and support for local producers of agricultural machinery are insufficient, especially considering the distribution of such subsidies in favour of large agricultural holdings.

But even with such a structure of the economy, it is possible to accumulate resources for progressive changes. The changes in tax policy prove that. In recent years, the level of the tax burden on agriculture has begun to correspond to the sector’s share in the gross domestic product. This was achieved via the cancellation of special taxation regimes that were in effect until 2015. As a result, net tax revenues increased 37 times in 4 years without leading to bankruptcies in the industry. Tax revenues from mining, a highly profitable raw industry, have also increased greatly. One of the consequences of cancelling such preferences may be increased competition for the exploitation of Ukrainian natural resources. International corporations, which have a greater safety, can force Ukrainian capital out in the struggle for the use of Ukrainian subsoil and land.

Another source of filling the state budget can be a cessation of the massive tax evasion in the agricultural sector. Ukraine’s budget annually loses billions of hryvnias as a result of offshoring, abuse of special tax regimes for agricultural producers, the growth of the shadow market and the illegal cultivation of state-owned land. The fight against these factors and the establishment of an adequate level of taxation can become fundamental both for agricultural production of a deeper degree of processing, and for the development of other branches of the economy, increasing the population’s access to social benefits. The imposed vector of agrarian and raw material development should be reviewed and supplemented with other promising areas that can become the basis of the sustainable development of the country.

References (in Ukrainian):

Аграрний тиждень. Україна, 2017. 1 млрд збитків через махінації з відшкодуванням спецрежиму. Доступ 4.04.2018 за адресою: [link].

Асоціація газовидобувних компаній України, 2018. Прийнято законопроект №3096-д щодо дерегуляції газовидобутку. Доступ 4.04.2018 за адресою: [link].

Кравчук, О., Одосій, О., 2015. «Оподаткування в Україні. Приховані ресурси». В: Журнал соціальної критики «Спільне». Доступ 4.04.2018 за адресою: [link]

Лупенко, Ю. О. та Тулуш, Л. Д., 2016. «Оподаткування сільського господарства в умовах трансформації спеціальних податкових режимів». В: Економіка АПК, №1.

Меморандум про економічну та фінансову політику з Міжнародним валютним фондом. Україна: лист про наміри від 21 липня 2015 року. (Українська версія з офіційного сайту Національного банку України). English version, IMF official site.

Національне антикорупційне бюро України, 2017. Розслідування НАБУ в галузі АПК: держпідприємствам відшкодовано понад 70 млн грн. Доступ 4.04.2018 за адресою: [link].

Небога, М., 2018. «Офшорні схеми в сільському господарстві України: вигоди для експортерів та втрати для бюджету». В: Журнал соціальної критики «Спільне». Доступ за адресою: https://commons.com.ua/uk/ofshorizaciya-ukrayinskoyi-ekonomiki

Офіс з фінансового та економічного аналізу у Верховній Раді України, 2017a. Кому відшкодовують ПДВ в Україні. Доступ 4.04.2018 за адресою: [link].

Офіс з фінансового та економічного аналізу у Верховній Раді України (ОФЕА), 2017b. Окремі аспекти адміністрування та справляння ПДВ у 2011-2016 роках. Доступ 4.04.2018 за адресою: [link].

Oфіційний сайт НАК «Нафтогаз України». Видобуток газу в Україні. Доступ 4.04.2018 за адресою: [link].

Рапопорт, В., 2017. «Державні гроші сільгоспвиробнику. Кому, скільки, для чого і чи потрібно». В: Texty.org.ua. Доступ 4.04.2018 за адресою: [link].

Український клуб аграрного бізнесу, 2017. Огляд імпорту продукції АПК з країн ЄС за січень-вересень 2017 у рамках ЗВТ Україна – ЄС. Доступ 4.04.2018 за адресою: [link].

Укрінформ, 2017. Аграрії на знак протесту перекривали дороги в п'яти областях. Доступ 4.04.18 за адресою: [link].

Уніан, 2017а. Дві американські компанії хочуть видобувати нафту та газ в Україні. Доступ 04.04.18 за адресою: [link].

Уніан, 2017b. Рада з 1 січня знизила ренту на видобуток природного газу на нових свердловинах. Доступ 4.04.2018 за адресою: [link].

Уніан, 2018. Збитки аграріїв після скасування відшкодування ПДВ при експорті олійних становитимуть 10-12 млрд грн щорічно. Доступ 4.04.2018 за адресою: [link].

Footnotes

- ^ For comparison, the share of agriculture, forestry and fishing in the European Union’s GDP was 1.7% as of 2017 (World Bank). — translator’s note

- ^ Here and below, the 2014-2017 data are given without taking into account the temporarily occupied territory of Crimea and part of the Anti-Terrorist Operation Zone.

- ^ In the structure of production of agricultural, fisheries and forestry products (group A of the National Classification of Economic Activities of Ukraine, DK 009:2010), agriculture, fisheries and forestry accounted for 95%, 0.5% and 4.5%, respectively (as of 2017). Therefore, the conclusions of this article about the sector can be applied to agriculture, with a possible error of 5%.

- ^ We remain sceptical of the activities of the International Monetary Fund in Ukraine, which promotes the implementation of tough market reforms in exchange for lending to Ukraine. At the same time, it should be recognized that due to changes in the taxation of raw materials sectors of the economy, the IMF is trying to stabilise the financial situation in the country and contribute to the budget replenishment.

Author: Oleksandr Kravchuk

Translation: Olenka Gu