On 9th November 2022 “Ekonomichna Pravda” organised a discussion with the deputy executive director of the IMF in Ukraine Vladislav Rashkovan and CEO Andrii Boitsun about the role of State Owned Enterprises (SOEs) in the post-war revival of Ukraine. This “role” turned out to be the liquidation of most SOEs. The main theses published after the discussion include:

“Everything that can be done by private capital must be done by private capital. A highly developed market economy requires more private sector investment.”

“It is impossible to manage a large [state] share [of the economy] without losing quality, so it is important to have a smaller state system, but more efficient.”

For the presenters, wartime creates exceptional circumstances for state ownership in the economy, although no clear reason is given. They do not criticise the nationalisation of gas companies owned by oligarchs Dmytro Firtash and Viktor Medvedchuk, aircraft manufacturer “Motor Sich” and the possible future nationalisation of Russian “Alpha Bank”. However, the conclusion is clear that in post-war Ukraine, the number of SOEs should be dramatically reduced. Very few concrete justifications are given for this conclusion - it is taken as an established fact that private ownership is better for peacetime Ukraine than a mixed economy. Is this really the case? When we draw lessons from one of the most enthusiastic countries in outsourcing public goods and services - the United Kingdom - this orthodoxy becomes much harder to defend.

A helicopter during the training of JSC "Motor Sich" pilots before the international competition in helicopter sports, Zaporizhzhia. Photo: Dmytro Smolenko / Ukrinform

State-owned companies - the neoliberal bogeymen

Many Western countries have SOEs, although usually this term is reserved for post-communist countries for dramatic effect. Prominent examples are railways (state-owned in France, Italy, Germany, Poland, Spain and others), postal services (France, Denmark, Sweden and others) and energy providers (France, Denmark, Norway).

In fact, most Western countries had a large number of SOEs until the 1980s. Since then, especially in the UK and US, there has been a trend of "outsourcing" these public services to private companies. Abby Innes, Associate Professor of Political Economy at the London School of Economics, has written extensively about the ideology and practice of outsourcing. Rather shockingly, she describes the current outsourcing obsession as "even less efficient than Soviet enterprise planning".

For Innes, the ideology of privatisation is a kind of dogmatic free-market radicalism, which prefers mathematical "rules of economics" based on rational-choice theory, rather than attempting to understand complex social realities. She compares this to Leninism, which also applied "scientific" laws of Marxism-Leninism over reality. She argues that when the solutions of the free-market radicals fail to work, they always assume that the answer is more free-market policies. This is very applicable to the Ukrainian reality, where Western "advisors" promoted rapid privatisation and liberalisation, leading to the economic collapse of the 90s. When countries like Ukraine failed to recover from this shock, they blamed it on the failure to "complete the transition" to a market economy, and continue to blame local elites every time their policy prescriptions do not improve the situation.

Stakhaniv, Luhansk region, early 90s. Photo: Josef Kudelka

An illustrative example of this mindset is Anders Åslund, a Swedish economist who advised many post-Soviet governments on their market transition in the 90s, and has authored over 25 books on building capitalism in the region. In a 2009 book “How Ukraine Became a Market Economy and Democracy”, he argued that the rise of the oligarchs was a positive or at least necessary development. He assumed that after accruing their vast fortunes, oligarchs would eventually become powerful advocates for property rights and the Rule of Law to protect their fortunes - as apparently is the case for Western billionaires - and argued that oligarchs were more willing to reinvest in their firms than other actors.

By 2015, in the book “Ukraine: What Went Wrong and How to Fix It”, he had evidently grown tired of waiting for the oligarchs to become honest businessmen, and blamed them (and not his own policy advice) for the failure of market reforms. This assumption that a retreat of the state from the economy in favour of a purely watchdog role will reduce endemic corruption and stimulate growth ignores evidence - in particularly from Georgia - that libertarian regimes can also exhibit state capture through other mechanisms such as the tax police and compliant courts.

Returning to Professor Innes, she argues that the traditional arguments for private provision (competition, anti-corruption etc,) do not make sense in relation to SOEs performing public services or producing public/mixed goods. In many cases, the state will want to provide services for free or lower than the market price. If they want a private company to take over this function, the state must sign a contract with the company. This will usually be a long-term contract, where the state offers a fixed price for services performed and certain quantified performance obligations.

There are many potential problems which can arise in such a situation. Firstly, corruption, favouritism and lack of transparency in the tender procedure is very common in Ukraine, as shown by the privatisation of the Kyiv machine-building factory “Bilshovik” in 2021, where despite the attractiveness of the land, of 15 potential investors only 3 made it to auction, where only 2 firms finally competed, with the final bid ending up only 40 million hryvnias (around 1.3 million euros) above the original asking price.

Kyiv machine-building plant "Bolshevyk" during the Soviet times

Secondly, unlike private goods, where consumers can always choose to switch suppliers, with outsourcing contracts there is only one supplier for many years. The more public services are operated by such contracts, the fewer opportunities exist for citizens to exercise democratic control.

Thirdly, private companies always try to maximise the profits from the contract, meaning providing the bare minimum service while complying with the contract. If the government realises the existing contract is leading to inadequate service, they must pay the company more to amend the contract. In the Ukrainian reality, the private company will probably have much more experienced lawyers than the state in these contract negotiations and any court cases which arise.

Fourthly, even if private companies offer poor-quality services, the state will likely renew the contract due to the high costs of switching to a new provider in most.

Finally, the whole process of outsourcing encourages a “revolving door” system between the private sector and the state. The government often tries to hire consultants to help negotiate and manage the ever-expanding number of contracts with suppliers. These same consultants often then return to highly paid jobs in those same companies. According to Innes, such “corporate state capture” is endemic in the UK, a country usually associated with the Rule of Law.

Let’s take the example of two companies working in the same sector: the state-owned postal service Ukrposhta and private Nova Poshta. The latter is more profitable, and (anecdotally) offers better quality service. Why not privatise Ukrposhta to improve service quality? In reality, Nova Poshta only operates in the most profitable areas of the market - mostly courier services. Meanwhile, Ukrposhta fulfils a variety of functions which are mandated by law, often with a price set by the state. For example, the collection of pensions and other social payments, humanitarian cash-transfers to IDPs since February 24th and intra-governmental communication and communication between citizens and the state. What would happen if these services were outsourced to a private company?

The automated terminal of "New Post" in Dnipro. The largest infrastructure facility of the company in the Dnipropetrovsk region. Photo: press service of the NP

Nova Poshta offers higher quality services because this encourages customers to use their more expensive services over competitors like Ukrposhta. If they won a contract to provide state-mandated services paid by the state or with fixed prices, this incentive would disappear. The new priority would be to meet the requirements of the outsourcing contract while spending as little as possible to maximise profit. This can involve making the service more efficient, but this usually requires significant investment and talented staff. The other option is to cut corners - provide the bare minimum of necessary services using low-paid staff, and hiring expensive lawyers to fight off challenges. The only way for the government to overcome this is to write increasingly complex contracts (requiring input from many civil servants).

Do profits matter?

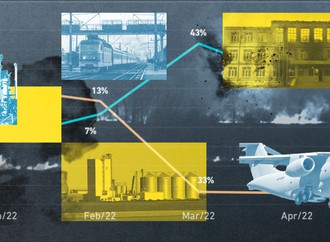

Returning to the article in “Ekonomichna Pravda”, the main empirical evidence to justify privatisation is the lower profitability of SOEs vis-à-vis private firms, which is shown in the table below.

Figure 4: Distribution of ROE: state-owned enterprises in relation to the private firms median in the respective sector and year (% of enterprises)

The presenters do not take the time to explain the implications of their data. Apparently, it is sufficient to prove the superiority of the private sector. However, they fail to consider the role of SOEs in the modern Ukrainian economy. Some SOEs produce pure “private” goods, which compete with private firms on the market. However, as discussed in the previous section, many SOEs produced “public” or “mixed” goods which are deemed necessary for the health of society. Why is profitability a useful metric to assess such companies, and not service quality or cost-efficiency?

Post-Soviet welfare states look very different to their Western counterparts. Features such as unemployment, child and disability benefits are often negligible or of secondary importance. State pensions are miserable and universal healthcare faces heavy constraints due to underfinancing and corruption. The main instruments of wealth redistribution are found elsewhere. The most significant is the subsidisation of household utilities. In countries where average incomes are lower than 300 euros per month, the convergence of household utility prices with European market prices has dramatic consequences for social reproduction. However, a “competitive market” in utilities has been a constant target of the IMF and other Western institutions for years. Even pro-Western governments have been reluctant to implement this fully due to the dramatic backlash from voters. That Ukraine - a country with significant domestic energy resources - should fully privatise all energy SOEs and introduce market pricing, likely giving super-profits to oligarch owned companies and leaving millions in poverty, is not a matter of “economic rationality” but a political question: who is allowed to benefit from Ukraine’s economic resources? Citizens or businesses?

Another example given in the article by Andrii Boitsun (an “independent corporate governance consultant”) of an SOE requiring post-war privatisation is the state railway operator Ukrzaliznytsia (UZ). The privatisation of the highly profitable freight component of the SOE has been on the radar of “Western partners” and companies for some time. Whether Ukraine would have been able to effectively organise the heroic evacuation of millions of people and the supply of soldiers and equipment to the frontline if UZ had been divided into many different private companies before the war is open to debate. In any case, currently UZ operates both the profitable freight business and unprofitable passenger business.

Evacuation train from Donetsk region at the railway station in Lviv, May 28, 2022. Photo: Adri Salido/Anadolu Agency via Getty Images

Why should the state sell off the most attractive part of UZ (and probably for low price, given the example of Bilshovik), but retain the unprofitable part? The answer is that many would like to see the passenger part privatised, but only if the government introduces market prices. A suburban train from Fastiv (a commuter town 90 minutes from Kyiv) cost 12 hrvna (~0.30 euros) before the Russian invasion. A sleeper train from Lviv to Mariupol (approximately 26 hours) could cost less than 20 euros. These prices are enough to make anyone who has bought a ticket on one of many privatised rail companies in the UK cry with despair. These prices were made possible by large deficits accrued by the passenger branch of UZ, but are an essential part of social reproduction. Without them, millions of Ukrainians living in small towns and villages, who rely on access to land plots for their survival alongside work in the big cities, would be driven deeper into hardship.

If we look beyond the blind faith in the private sector of the “Epravda” discussants, we are right to ask: why should profit be the main objective of UZ, and not the ability of Ukrainian citizens to travel across their country for tourism, visiting loved-ones or work. Doesn’t every region of Ukraine benefit economically from the flow of people rolling across the country in platzkart wagons?

There are no doubt many SOEs in Ukraine with very poor performance due to underinvestment and mismanagement. But when we look at the infographic from “Epravda”, in each industry listed there are almost certainly SOEs which peform essential social and economic functions. Even the sector with the lowest relative profitability of SOEs - construction - is worth examination. Roadbuilding and other public infrastructure is undoubtedly crucial for society, yet many Ukrainian rightly associate these sector with rampant corruption. However, even in countries where 100% of public infrastructure is outsourced to private companies, there remains a huge potential for corruption in countries with weak Rule of Law and state capture by elites.

Conclusion

The insistence on privatisation as a “holy grail” to solve Ukraine’s economic problems shows that its proponents do not have any real ideas about how to improve the management and performance of SOEs. Not only that, but when “experts” and international organisations like the IMF push for privatisation of SOEs without considering their social function, they discourage the Ukrainian government from making meaningful investments in SOEs which might (alongside meaningful reforms) improve service quality. The Russian invasion has already been used as a smokescreen to introduce a dramatic reduction in worker protection, which before the war was successfully opposed by trade unions. As Adam Tooze has written, this and other radical marketisation reforms pushed through in the haze of war risk damaging the national solidarity Ukraine needs to win the war. Ukrainians and their allies across the world need to be watchful that buzzwords like “post-war recovery” do not provide the justification for radical transformations of the Ukrainian economy in favour of oligarchs, foreign and domestic companies, but not in favour of the Ukrainian people.

![Reconstruction and Justice in Post-War Ukraine [video]](/file/thumbnail/%D0%BA%D0%BE%D0%BD%D1%84_category.png)